“APAC THEREFORE plays a crucial role in the

THIS YEAR’S

ESTABLISHED IN 1988, the

“APAC THEREFORE plays a crucial role in the

THIS YEAR’S

ESTABLISHED IN 1988, the

THE

SENATE BILL 512 advanced during the General Assembly’s spring session but never reached a vote. It was revived in the fall veto session with an accompanying amendment.

THE BILL, sponsored by Rep. Tom Cross (R-Plainfield), would set three tiers of pension benefits and costs for current employees who pay into the State Universities Retirement System.

OPTIONS INCLUDE:

A $110,000 cap on salary earnings used to calculate pensions and an increase in retirement age to 67 would apply to employees hired after Jan. 1, 2011.

“WE CONTINUE to press for a solution to the state’s pension funding concerns that doesn’t unjustly place the entire burden on the backs of our hardworking employees,” President Michael Hogan wrote in a Nov. 1 email to the campus community.

“I ENCOURAGE you to contact your legislators using your own personal email and resources to assert the importance of a fair solution and the problematic aspects of SB 512.”

IF PASSED the bill, which would not affect those already retired, would become effective July 1, 2013.

QUESTIONS HAVE been raised about the legality of changes to retirement benefits for current state employees due to a clause in the Illinois Constitution reads: “Membership in any pension or retirement system of the State ... shall be an enforceable contractual relationship, the benefits of which shall not be diminished or impaired.”

FOR MORE information on the proposed legislation, visit:

By Michael J. Hogan

University of Illinois President

IT’S EASY to understand the Law of Unintended Consequences, the unanticipated and sometimes perverse effects of actions--sometimes government actions--that were ostensibly intended to provide a public good.

EXAMPLES OF this principle abound, but one that is often noted these days has to do with Senate Bill 512, now under discussion in Springfield, to fund the State's pension obligations to public employees. Leaders in

THE LIKELY effect of Senate Bill 512 in its current form will be a brain drain from these public universities and their surrounding communities.

THE UNIVERSITY of

MAKE NO mistake about it, these outstanding and civic-minded employees have choices in a competitive market place not bound by geography. Those who leave may take their externally funded research projects worth millions of dollars with them and take their pension, too. Replacing these employees with comparable talent will be difficult so long as other universities are offering better benefits.

SUCH AN exodus would devastate our ability to meet the U of I's teaching, research, public service, and health care missions, and would slam the brakes on what has consistently been a vibrant economic engine for this great State.

AMONG THE top teaching and research universities in the world, the U of I and its three campuses directly and indirectly generates more than 150,000 jobs and more than $13 billion in economic impact for

BUT THE proposed pension funding legislation will make it difficult to do that, and to recruit other highly professional faculty and staff. It will damage the public university system in

AS WE contemplate the State's strategic advantages, how does it help in the long term to reduce funding for higher education, including two public Tier One research campuses, and provide substantially less compensation to its talented workforce?

WE KNOW that a solution to the pension problem is urgently needed, and we are willing to contribute our fair share to an equitable solution. But it needs to be based on the principles of equity and shared sacrifice, to which we can all contribute without doing great damage to the educational institutions central to the well being of our students and to the State's place in a knowledge-based economy.

I URGE legislators to consider the interests of our employees, the impact of their departure, and the threat that weakened public universities pose to the future of the State. The potential consequences are far too great to ignore.

(THIS ARTICLE originally appeared in the Chicago Sun-Times on Sunday, Oct. 30. Reprinted with permission of the Office of the University President.)

By William S. Bike

DAVID MERRIMAN, Associate Director and Professor, Institute of Government and Public Affairs (IGPA), and Associate Dean for Faculty Affairs and Professor, College of Urban Planning and Public Affairs, spoke on “Illinois’ Economic and Fiscal Challenges and Responsibilities” to the University Senate recently.

MERRIMAN EXPLAINED that the University’s Board of Trustees requests such analyses from the IGPA.

HE NOTED that

MERRIMAN SHOWED an Unemployment Rate graph, in which

ANOTHER CHART showed total State expenditures from 1997 to 2012, which revealed that the share to higher education has dropped from about seven percent to about four percent.

MERRIMAN CONCLUDED that the State asking for a recission (return of funds from the University) was not out of the question.

ALL APs are invited to the monthly APAC meeting at 12:30 p.m. on the second Wednesday of the month. The next meeting will be held Wednesday, Dec. 14, in Room 5175 of the College of Medicine Research Building, 909 S. Wolcott. Every other month, a meeting is scheduled in Room 2750 of University Hall on the East Campus. Also scheduled are meetings Jan. 11 in Room 2750 UH, Feb. 8 in Room 5175 CMRB, March 14 in Room 2750 UH, April 11 in Room 5175 CMRB, May 9 in Room 2750 UH, June 13 in Room 5175 CMRB, July 11 in Room 2750 UH, Aug. 8 in Room 5175 CMRB, Sept 12 in Room 2750 UH, Oct. 10 in Room 5175 CMRB, and Nov. 14 in Room 2750 UH. For information, call (312) 996-0306.

UIC UNITED, the UIC Chapter of the State Universities Annuitants Association (SUAA), has announced a new dues program for UIC employees: Sign up for dues deduction from paychecks at $2.75/month, a discount of $0.25/month. Follow the link in the first sentence for an online application. First, check the button next to Current Employee (after Employment Status). Then scroll down to the drop-down menu after College/University and display

GET 24/7 access to a Zipcar, a car-sharing service with autos parked at several locations around campus, across the city, and around the world. After joining Zipcar, you can reserve a car online, let yourself in with a Zipcard, and drive. Hourly and daily rates include gas and insurance, with no maintenance or car payment charges. Campus locations are

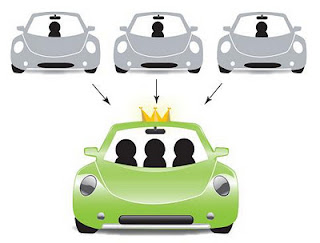

UIC HAS partnered with iCarpool, an online ride-matching service, to bring employees a new transportation program that helps find ride sharing opportunities.

BY CARPOOLING instead of driving alone, participants can save 50% or more on travel and vehicle expenses, improve outdoor air quality, and reduce greenhouse gas emissions by 3,000 lbs. per year.

TO REGISTER, visit http://bit.ly/UICiCarpool and setup a profile using your @uic.edu or @illinois.edu address. Note that this is not directly linked with your netid. For additional details, visit http://commuter.uic.edu/icarpool orhttp://sustainability.uic.edu/icarpool.

EMPLOYEES ARE encouraged to take advantage of the iCarpool program by registering as a participant; check back frequently to find carpool matches as site membership increases.!

FOR INFORMATION contact icarpool@uic.edu or (312) 413-7440; the UIC Office of Sustainability, sustainability@uic.edu, (312) 413-9816; or the

Editor’s Note: “The Continuing Crisis” is a section of APAC News which links to news pertinent to the state budget crisis and other financial matters as they affect the University and Academic Professionals. These news outlets are not affiliated with or endorsed by APAC.

PUBLIC SAYS use taxes and cuts to solve State budget crisis. See KFVS-TV Channel 12, http://www.kfvs12.com/story/15787794/illinois-voters-favor-some-cuts-some-taxes-to-fix-broken-budget.

ORGANIZED BY the University of Illinois Institute of Government and Public Affairs (IGPA), the event kicked off Oct. 3 with keynote speaker Alicia H. Munnell, a professor of management sciences at

Pension Reform: How to Get from Here to There

MUNNELL, WHO was a member of the President’s Council of Economic Advisers and assistant secretary of the treasury during President Bill Clinton’s administration, spoke about “Pension Reform: How to Get from Here to There.”

SHE NOTED that public pensions “were not considered a problem before the 2008 economic meltdown” and that, even before then, the “funding ratios for

A DEFINED benefit (DB) plan is a traditional pension, an employer-sponsored retirement plan set up to pay a fixed monthly amount to eligible employees during their retirement years. The employer takes complete control over investment risk and portfolio management and determines each employee’s retirement benefit based on a formula—generally expressed as a percentage of annual salary—that takes into account the employee’s age, years of service, and earnings.

IN A defined contribution (DC) plan, the employer sets up an individual account for each participant and contributes a fixed amount to each account annually. The amount of each person’s monthly retirement benefit is not fixed nor guaranteed because it depends on the amount of money in the individual’s account at retirement. Also, the individual must bear responsibility for all investment risk and portfolio management. Individual retirement accounts (IRAs) and 401(k)s are examples of DC plans.

MUNNELL SUGGESTED moving away from DB pensions for State employees but did not go so far as to call for a complete switch to DC plans. Instead, she called for a hybrid plan.

“CONTEMPLATED CHANGES in

WITH ILLINOIS not contributing its full ARC, the State has been selling pension obligation bonds to raise money for the pension fund. Proponents believe

“THAT’S CRAZY,” Munnell said.

MUNNELL ALSO noted that cost of living adjustments (COLAs) “get these plans in trouble.” The COLA in

SHE OFFERED a two-fold solution to

RESPONDING TO Munnell was Jeffrey Brown, professor of finance at the

WHILE TYPICALLY Munnell and Brown have occupied opposite sides of financial arguments in their careers, when it comes to

BROWN ALSO does not favor

“THE CONVERSATION should be changed from ‘us vs. them’ to designing a good pension program,” Brown concluded

ANTHONY LADEN, an associate professor of philosophy at the

PENSION REFORM agreement appeared even more difficult in

“YOU HAVE to be careful that you don’t get so polarized that you can’t deal with pension reform,” Berardino added. “Accepting reality isn’t fun, but that’s what both sides have to do to reach a workable agreement. Conservatives have to accept that collective bargaining isn’t going away. Labor has to accept that some pension reforms are necessary to preserve defined benefits. Everyone has to accept that pensions are complicated and most people—particularly journalists and lawmakers—don’t fully understand how they work.

“BOTH SIDES have to start selling this idea of accepting reality early on if you really want to reach a solution,” Berardino continued. “Or you can just beat each other up verbally. It’s easy and it pleases your constituents, but it doesn’t solve anything. Politicians and union leaders get elected by saying ‘no compromise.’ But you have to move away from this. We said to the elected officials, ‘No matter how much you dislike us, we aren’t going anywhere, so learn to work with us.’

“WORKERS HAVE a much better shot at protecting our benefits if we’re part of forming a solution,” Berardino said.

BERARDINO EXPLAINED why he believes public pensions are in crisis today. “In the late 1990s, most public pension accounts were well funded,” he said. “There was pressure to improve benefits,” and with the economy booming and plenty of money in government coffers, “enhanced formulas were adopted with overwhelming bipartisan support.”

WITH THAT no longer the case, conservatives pressured public employees to give up traditional DB plans. “Conservatives basically said, ‘Our money is in 401(k)s, and we’ve lost 70% of our retirement benefits. So should you.’”

WHILE THAT obviously was not a good deal for employees, a deal that could be sold to both sides was the approach Munnell spoke about earlier: Orange County and union officials created a hybrid retirement plan for employees that was part DB pension, part DC.

THE

“WE COULD sell that to our members because we showed mathematically how some could actually make more money in retirement with the hybrid,” Berardino explained, noting the City of

“IF WE as Americans can accept the core principles of fairness, we can come up with a solution,” Berardino concluded.

ACCORDING TO Public Sector Inc., an online forum on public sector issues and taxes published by the Center for State and Local Leadership at the Manhattan Institute for Policy Research, “The Civic Committee of the Commercial Club of Chicago has floated a pension reform for Illinois that would essentially copy private sector practice—existing pension plans would be terminated, and existing workers would keep their benefits accrued to date while receiving future benefits in a new pension system.”

RESPONDING TO Berardino was Tyrone Fahner, president of the Civic Committee of the Commercial Club of Chicago and a former attorney general of

PARITY BETWEEN State employees hired on or after January 1, 2011 and State employees hired before that date has become an issue because benefits for the two groups are so different. In the State Universities Retirement System (SURS), for example:

Employees hired before January 1, 2011

Retirement is age 60 with eight years of service, 62 with five years of service, or any age with 30 years of service; early retirement age is 55 with eight years of service. Vesting period is five years. Final salary is considered the average of the highest four consecutive years or the last four years, whichever is greater. Retirees get 80% of final average salary, no matter how high the amount.

Employees hired on or after January 1, 2011

Retirement is age 67 with ten years of service; early retirement is age 62 with ten years of service. The vesting period is ten years. Final salary is considered the highest eight years within the last ten years of service. Pensions are capped at $106,800 per year.

FAHNER SAID his organization is pushing to bring up Senate Bill 512 in the Illinois General Assembly in the fall; under this bill, State employees could either pay more for benefits or pay less but get fewer benefits. He noted that “If 512 is passed, we don’t want to see any benefits taken away that have already been earned.”

THE NEXT speaker was Henry Bayer, executive director of the American Federation of State, County, and Municipal Employees (AFSCME) Council 31.

BAYER SAID, “

“SO LET’S confront reality,” Bayer continued. “The problem here in

“THE STATE Constitution says the State will not impair the benefits of employees,” Bayer explained. “Officeholders swear to uphold the Constitution. You can’t just toss this aside. All of the plans put forth are to cut pension benefits. None advocates funding the pensions. We do need changes; we acknowledge we have a problem. Our members are being asked to sacrifice; we have in the past. The last time the pensions were reformed, our members agreed to forego a pay increase and agreed to work longer for full retiree health benefits. We have shown our willingness to step up to the plate.

“THE BILL changing benefits for new employees was a disgrace,” said Bayer. “It was passed quickly, with one speaker for each side given three minutes. We are more than prepared to face reality, but there is nothing in the proposed pension changes that requires the State to act responsibly.”

SOME HAVE said reducing State employee pensions would be preferable to raising taxes on corporations to gain the money to fund the pensions because the corporations are “job creators.” Bayer addressed this point by noting that “three-quarters of the corporations in this State pay no income tax. It drives me crazy to read in the paper when some business threatens to leave the State if they don’t get a tax break. Motorola and Caterpillar got tax breaks, and then left.

“WE’VE got to stop giving out handouts to these businesses that pay lower taxes than individuals,” Bayer said. “We earned our benefits. They get giveaways.”

BERARDINO ECHOED Bayer, noting “the money that we’re saving business here through giveaways is not being spent by them here. They are taking the jobs offshore.”

Small Group Discussions

SMALL GROUP discussions came next. Darren Lubotsky, who holds appointments at GIPA and in the Department of Economics at UIUC, led the discussion about “Pensions as a Component of Total Compensation.”

DAVID MERRIMAN, associate director of IGPA and a professor of public administration at UIC’s

THE STATE Constitution has a “non-impairment” clause that protects government employees’ earned benefits, saying such benefits cannot be reduced or altered. It is therefore constitutionally unclear what changes can be made in employee pensions. Does that mean future costs and benefits to current employees must remain unchanged, or does it mean accrued benefits are safe, but costs and benefits can be changed for current employees going forward? J. Fred Giertz of IGPA, a professor of economics at UIUC, led a discussion on this topic.

GROUP LEADERS for the small group discussions summarized conclusions their groups reached.

MERRIMAN SAID, “Tone down the rhetoric. Make the process as transparent as possible. There should be agreed upon, objective facts as to what the situation is with the pension plans. And whatever is arrived at should be arrived at with consensus, not rammed down anybody’s throat. There should be common goals. Whatever solution is achieved has to be realistic in the share of the budget it takes. Retirees should be guaranteed a basic minimum level for a decent retirement.”

LUBOTSKY NOTED pensions should be thought about “in the context of the total compensation package. Whatever we spend on pensions, we want to maximize the value for everyone. And all involved should realize that most people aren’t equipped to make good pension decisions, so design the pension to insulate people from bad decisions.”

GIERTZ CONCLUDED that “underfunding has to become a thing of the past. There has to be a buy-in to the concept of shared sacrifice and shared contribution. We could make changes in areas not covered by the non-impairment clause, such as retirement healthcare. And we have to think about the transition process—how do we get to where we want to be from where we are?”

SENGER ASSERTED, “When we think of pensions, we shouldn’t think so much about the numbers, but about the people. I welcome everyone’s input so we can make better decisions. It’s important not to use scare tactics about pensions. We want to come up with something sustainable for the long run.”

NEKRITZ BELIEVES that “to solve the budget crisis, we have to use every arrow in our quiver—raising revenues and making cuts. I don’t believe we can take a certain percentage of the budget and say we can’t touch that. We must find a way to make the pension system sound.”

BRADY WANTS the State to make some hard choices. “We have an unfunded liability of $85 billion. Thirty-nine states have revised pension reforms similar to Senate Bill 512—employees have to ‘pay to stay’ in Tier 1; there will be lower contributions with lower benefits in Tier 2, with a DC plan. The State ideally should increase its contributions to pay down our pension debt and decide on no more pension borrowing. The State should pay in cash, on time.”

RAOUL TOOK exception to the views of some that the problem can be laid at the feet of former governor Rod Blagojevich. “This is not a problem that came about with the Blagojevich administration,” Raoul said. “It’s decades old. We legislators must point the finger inward. It’s the Legislature’s fault—both parties—not the fault of the employees. To fix the problem, we have to use an appropriate process that observes our State constitution.”

Wrapup

UNIVERSITY PRESIDENT Michael Hogan had the final word of the day. “Pension uncertainty is hurting us in recruiting the best and brightest employees for the

“AS PRESIDENT of one of the State’s largest employers, I’d be remiss if I didn’t advocate for a stable pension system for our employees,” Hogan concluded.

IGPA IS a public policy research organization based in all three